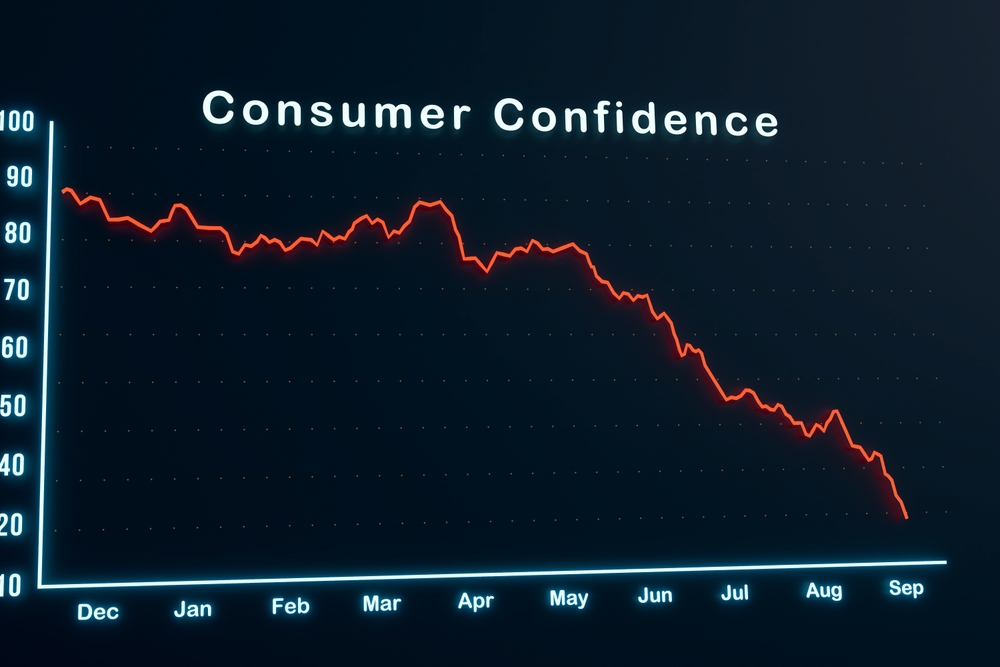

The latest numbers are in, and they show a sharp decline in consumer confidence. The Conference Board reported that April’s Consumer Confidence Index (CCI) dropped to 86.0 from 93.9 in March. That’s the lowest level we’ve seen since mid-2020—and it could spell trouble not just for shopping and jobs, but also for the housing market.

What Exactly Is the Consumer Confidence Index?

The CCI basically tells us how everyday Americans are feeling about the economy—both now and in the near future. It’s based on two main things:

- How people view current business and employment conditions

- How they expect things to go over the next six months

If folks are nervous about inflation, job cuts, or their ability to earn and spend, the index drops. When that happens over a few months, it often points to a larger economic slowdown.

This Isn’t Just a Small Dip

This marks the fifth straight month the index has fallen, and it’s the biggest one-month drop since May 2020, right in the early chaos of the pandemic. Historically, when confidence takes a nosedive like this, the housing market tends to slow down soon after.

A quick look back:

- In 2008, consumer confidence fell hard right before the housing crash and the Great Recession.

- In early 2020, it plummeted as the pandemic hit, bringing the housing market to a temporary standstill.

Why This Matters for Real Estate

When people are uncertain about their finances, they tend to hold off on major decisions—like buying or selling a home.

- Buyers hesitate because they’re worried about job security or affording a mortgage.

- Sellers wait it out if they think there won’t be enough demand.

- Prices may slow down as fewer buyers create more available homes on the market.

Affordability is already tight with high interest rates and elevated home prices. A drop in confidence could make it even harder for buyers to justify making a move.

What Comes Next?

This doesn’t mean a housing crash is on the horizon, but it’s definitely a sign to stay alert. Keep an eye on:

- Pending home sales, which are already declining

- Mortgage application activity

- Job numbers and any increase in layoffs

If consumer confidence continues to fall, we could see a much slower housing market heading into the summer. Buyers, sellers, and agents alike should be prepared.